"All our "big" chemicals are polyethylene, polypropylene and rubbers. They go directly into packages, pipes, tires, so you need to switch to medium—tonnage and low-tonnage chemicals," experts say, evaluating SIBUR's new investment project in Nizhnekamsk. Two new production facilities will "grow" at NKNH: ethylbenzene and styrene, as well as polystyrene worth 180 billion rubles. At one time, the "styrene" project was conceived by TAIF, but their plans were destroyed by sanctions. SIBUR was supported by their Chinese shareholder, Sinopec. About how promising the polystyrene market is and what impact the new production in the Republic of Tatarstan will have on it — in the material "BUSINESS Online".

A new 180-yard project

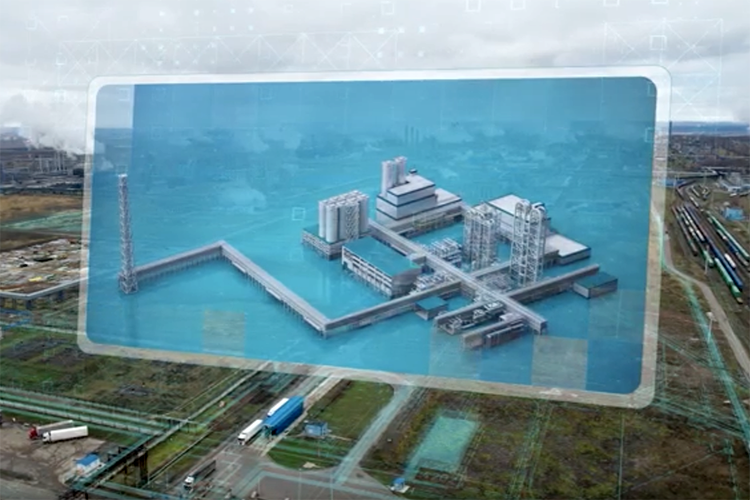

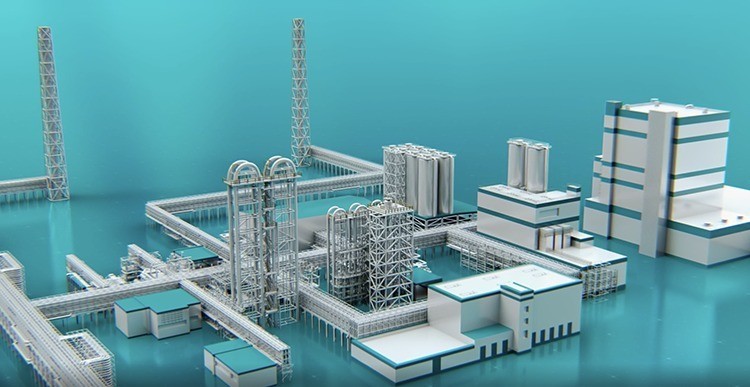

On the eve of the RAIS of Tatarstan, Rustam Minnikhanov, together with SIBUR CEO Mikhail Karisalov, visited Nizhnekamskneftekhim PJSC. The head of the republic was presented with a new investment project worth more than 180 billion rubles (the source of funds is traditionally not disclosed). We are talking about two new productions. This is the installation of ethylbenzene and styrene, as well as the installation of polystyrene (PS). Polystyrene will be the final product of this chain. The design capacity of the production facilities is 350 thousand tons of ethylbenzene, 400 thousand tons of styrene and 250 thousand tons of polystyrene per year, respectively. The raw materials for them will be the products of the EP-600 complex, which will release the first tons of products this year.

Machine builders and manufacturers from Russia and friendly countries will be involved in the supply of equipment and materials for the new project. Construction is scheduled to begin in 2025, and commissioning is scheduled for 2028. During the peak of work at the site, up to 7.2 thousand specialists from Russia and neighboring countries will be involved. SIBUR noted that migrant workers will be accommodated in the existing and newly built dormitories of the shift camp on the territory of the NKNH. Obviously, by this time the construction of the EP-600 will have come to an end, so the number of migrants at SIBUR's construction sites will not double. At the same time, the issue of assimilation of foreign guests remains important, the district authorities are working on this. Now, as we know, the NKNH security officers, together with the construction work coordinators, monitor the observance of the rules by guest workers.

Machine builders and manufacturers from Russia and friendly countries will be involved in the supply of equipment and materials for the new project. Construction is scheduled to begin in 2025, and commissioning is scheduled for 2028. During the peak of work at the site, up to 7.2 thousand specialists from Russia and neighboring countries will be involved. SIBUR noted that migrant workers will be accommodated in the existing and newly built dormitories of the shift camp on the territory of the NKNH. Obviously, by this time the construction of the EP-600 will have come to an end, so the number of migrants at SIBUR's construction sites will not double. At the same time, the issue of assimilation of foreign guests remains important, the district authorities are working on this. Now, as we know, the NKNH security officers, together with the construction work coordinators, monitor the observance of the rules by guest workers.

It is still unclear how big the impact of new industries on the ecology of the city will be. In 2022, the project was approved at public hearings, but environmental expertise and Glavgosexpertiza are still ahead — to pass these steps, the company will need to prepare project documentation.

It is worth recalling that TAIF began work on the "satellite plant" of the EP-600 megaethylene. In April 2021, NKNH signed contracts with the American Lummus Technology LLC for the provision of licenses and engineering services. However, the configuration of the project was much more modest — only 250 thousand tons of ethylbenzene and styrene. Albert Shigabutdinov's group discussed the same project with South Korean corporations Samsung C& T and Hyundai Engineering. However, the sanctions then reset the agreements with partners from unfriendly countries. As it became known to BUSINESS Online, help came from the Chinese shareholder SIBUR — the license agreement was eventually signed with Sinopec (more precisely, Sinopec Engineering Group Rus LLC).

It is worth recalling that TAIF began work on the "satellite plant" of the EP-600 megaethylene. In April 2021, NKNH signed contracts with the American Lummus Technology LLC for the provision of licenses and engineering services. However, the configuration of the project was much more modest — only 250 thousand tons of ethylbenzene and styrene. Albert Shigabutdinov's group discussed the same project with South Korean corporations Samsung C& T and Hyundai Engineering. However, the sanctions then reset the agreements with partners from unfriendly countries. As it became known to BUSINESS Online, help came from the Chinese shareholder SIBUR — the license agreement was eventually signed with Sinopec (more precisely, Sinopec Engineering Group Rus LLC).

"Drove into the wall": what is EP-600 and why is it important for ethylene to create styrene chain projects?

Why does SIBUR need a new multibillion-dollar project? The holding has been puzzling over where to direct the entire volume of ethylene that will be produced at the EP-600 ethylene plant under construction for a long time. This was partly a weak point of the project of the previous "owners" of the petrochemical industry of Tatarstan — it so happened that the implementation of the complex is faster than the production of derivatives (i.e. derivatives) of ethylene is projected. At a press conference in March this year, Karisalov mentioned among the possible projects the production of styrene and polystyrene, the reconstruction of the production of valuable grades of polyethylene at Kazanorgsintez, the reconstruction of the production of ethylene oxide, etc.

The olefin complex with a capacity of 600 thousand tons of ethylene per year is one of the main strategic projects of Nizhnekamskneftekhim. The new production facility will allow processing straight-run gasoline with a volume of 1.8 million tons per year to produce ethylene, propylene, benzene and butadiene. Most of the items that surround us on a daily basis are made of them: from food storage packaging, shelters for greenhouses, window profiles and ending with medical syringes and pipes for public utilities. The construction of the complex is included in the long-term Strategy for the development of the chemical and petrochemical complex of Russia until 2030.

"Licensors and a number of European equipment suppliers turned their backs on us. It is not possible to carry out installation and commissioning work with them. The level of provision of automated control systems, ACCORDING to ... even drove into the wall somewhere," complained Marat Falyakhov, Director General of the National Research Institute of Agriculture, at the board of the Ministry of Economy of the Republic of Tatarstan at the beginning of the year. Nevertheless, now the EP-600 complex has already been built by 93.2%. The number of construction personnel is 6.5 thousand people. The first production is scheduled for the end of 2024. The launch of the most complex equipment takes place without the manufacturers of this equipment themselves (it was purchased before the sanctions). The challenge is being overcome by the SIBUR team.

Until the launch of new ethylbenzene, styrene and polystyrene production facilities, the main consumers of EP-600 products will be the modernized production of high—density polyethylene at Kazanorgsintez (launch - 2024) and the production of hexene sold by the company at Nizhnekamskneftekhim (2025).

Experts expect an increase in global demand for polystyrene

Over the past few years, most of the new projects in the Russian petrochemical industry have been related to the production of polyolefins (polyethylene and polypropylene). The exception was the launch at the end of 2014 of the Rusvinil plant (at that time a joint venture between SIBUR and SolVin), which produces polyvinyl chloride. At the same time, the country's economy needs not only polyethylene and polypropylene, but also other polymers, said Anastas Gatunok, head of the Department for Analytics in the chemical industry at the Fuel and Energy Analytical Center (AC TEK) under the Ministry of Energy of the Russian Federation, to BUSINESS Online. In particular, we are talking about polystyrene, which is widely used for the production of various building materials, packaging, as well as in mechanical engineering.

How is this market organized now? In Russia, 500 thousand tons of polystyrene were produced in 2023, which is 2.9% less than in 2022. Of these, more than 400 thousand tons (i.e. 80% of the total volume) were produced by SIBUR at the facilities of NKNH and SIBUR-Khimprom. Domestic consumption of polystyrene in Russia amounted to 470 thousand tons (445 thousand in 2022). "That is, in absolute terms, these figures allow us to call the market balanced. At the same time, imports amounted to 55 thousand tons, and exports — 90 thousand tons (almost 120 thousand tons in 2022)," Gatunok cited the figures.

So, together with the launch of the new installation, SIBUR notes, Russia's capabilities in the production of polystyrene will increase by almost a quarter, which by a margin covers the existing volumes of imports of this polymer from abroad. In the post—Soviet space, PS is produced only in the Russian Federation, so experts do not see any problems with sales — part of the volume will replace imports, part will be exported. "Brands are imported to Russia that are not produced in the country or are produced in insufficient volume. Therefore, any new project for the production of polystyrene is certainly important for the country both from the point of view of import substitution and from the point of view of increasing the supply of high—margin products for export," said the representative of the AC Fuel and Energy Complex.

Polystyrene produced in Russia is mainly used in the domestic market, only 6% is exported, and the development of petrochemical industry capacities will reduce resource orientation and ensure the export of polymer products with added value, agrees Tamara Safonova, CEO of NAANS-Media. Domestic demand for polystyrene is increasing due to construction, packaging and the automotive industry, and export potential is increasing in the foreign market, said Yaroslav Kabakov, Director of Strategy at Finam IC.

"Asia and Europe remain key export destinations for Russian products. According to the data of the analytical company Grand View Research, the global polystyrene market will grow by 3-4 percent annually," he said.

Where is polystyrene used?

The redistribution of the product basket between existing and new NKNH production facilities will allow additional loading of the line for the production of ABS plastics (design capacity - 60 thousand tons per year). Consumption of this product in Russia today is about 50 thousand tons per year, of which about 30 thousand tons per year are imported, which can thus be replaced. "As a result, the increasing demand for modern synthetic materials from end—manufacturers — large household appliances, food packaging, medicine, the automotive industry, as well as the construction industry - will be provided," the company added.

"This chain will become the basis for a whole "bush" of low-tonnage chemicals"

The styrene chain is an important topic for the country, Alexander Babynin, CEO and co-owner of Orgneftekhim Holding, shared with BUSINESS Online. Thanks to the conversion products, according to him, a large number of small and medium-sized businesses may appear. "What is this archiveness? All our "big" chemicals are polyethylene, polypropylene and rubbers. They go directly into bags, pipes, tires. Things are still not so simple with PE because of the "green" agenda. Therefore, it is necessary to switch to medium-tonnage and low-tonnage chemistry. The new project [of SIBUR] is just medium—tonnage chemistry," our interlocutor pointed out.

Russia must create its own markets for the consumption of promising products, he continued. The domestic market alone is not enough. Next come the countries of the Islamic world, then the states of Africa. They say, "the Arabs have a lot of oil and gas, but they will gladly take the products of conversion." He paid special attention to ethylbenzene, one of the key base substances from which many low—tonnage chemical products can be made. "This chain will become the basis for a whole "bush" of further processing of low—tonnage chemicals," Babynin stressed. — When we talk about import substitution, Russia needs materials. And it's not polyethylene, or polypropylene, or rubbers. These are products of the conversion of ethylbenzene and styrene. Therefore, the Ethylene-600 Industrial Park is a pilot project of great importance for Russia. I believe there will be many such parks."

"The fact that Timur persuaded SIBUR… I'm surprised": Alabuga and NKNH will give birth to a technopark with a 1.3 trillion swing.

Source: business-gazeta.ru